|

Sponsored Content |

Sponsored

By John Chang

As the economic expansion approaches its 10th year, many investors have begun to transition their real estate strategies to a more balanced portfolio that integrates geographic and property-type diversification. On average, commercial real estate values have increased by 68 percent since 2009, offering investors significant appreciation and, in many cases, a large pool of equity. Numerous private investors have focused their real estate investment approaches on a sole property type and often a single metro. Investors tend to focus on asset types and markets they know, but this strategy poses a significant portfolio risk.

Recent natural disasters such as the hurricanes that affected Texas and Florida or the wildfires in California reiterate the importance of geographic diversification. Investors who concentrate their portfolios in their local markets have a clustering of risk susceptible to major natural disasters and local economic volatility. The Houston metro recently demonstrated both environmental and economic risks as the downturn in oil prices softened the local economy and the real estate market. Hurricane Harvey in 2017 compounded the local downturn, inflicting $125 billion of damage on the metro. For commercial real estate investors with all their holdings in Houston, this sequence of events dramatically impacted their cash flow and asset values.

Geographic diversification across multiple states helps reduce the risk potential of a natural disaster and localized economic risk. Investors holding multiple assets in a single market, particularly one dependent upon a single employer or industry, face disproportionate risk. Acquiring properties in dynamically different metros can reduce the impact of such an event. Assets in upper Midwest markets like Detroit and Cleveland may have higher reliance on the auto industry, whereas the Bay Area is strongly influenced by the tech sector. Each industry has its own cycle and by holding assets in each, an investor could mitigate some cyclical risk.

Geographic diversification across multiple states helps reduce the risk potential of a natural disaster and localized economic risk. Investors holding multiple assets in a single market, particularly one dependent upon a single employer or industry, face disproportionate risk. Acquiring properties in dynamically different metros can reduce the impact of such an event. Assets in upper Midwest markets like Detroit and Cleveland may have higher reliance on the auto industry, whereas the Bay Area is strongly influenced by the tech sector. Each industry has its own cycle and by holding assets in each, an investor could mitigate some cyclical risk.

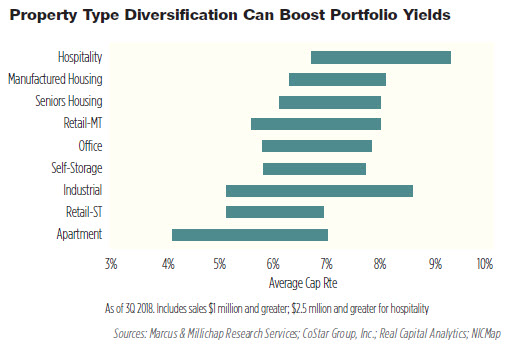

Diversification across property types also helps investors manage their risk. Not only does this reduce exposure to specific cycles tied to individual asset types, but it also gives investors much more flexibility when setting strategies. For some investors, shifting a portion of a portfolio from multifamily assets into retail or office properties could boost portfolio yield, while also reducing risks associated with the housing sector. Single-tenant retail assets have become particularly favored in recent years because they tend to be less management intensive than other property classes and they offer a steady, predictable yield. Self-storage is another asset type with minimal direct management needs that can be part of a favored diversification strategy. Both property types tend to have less risk associated with economic cycles.

The length and durability of the current growth cycle has boosted investor equity and market liquidity. Investors face a favorable climate to consider portfolio strategies and mitigate downside risk. Although no signs of economic softening have yet appeared, many economists anticipate slower growth in the coming years, making now an opportune time to consider a range of investment options both in terms of location and property type.

John Chang serves as the senior vice president and national director of research services for Marcus & Millichap Inc.

Learn more at www.marcusmillichap.com.